Where Strategy Meets Execution

Global Reach, Local Presence

Botsford Associates is a boutique management consulting firm with deep subject matter expertise in capital markets, wealth management, and asset management.

We provide strategic guidance and tailored solutions to our client's most critical and transformative projects globally. Our project portfolio encompasses many initiatives, from complex regulatory changes to operational optimization and digital transformations.

By bridging the gap between business and technology, we enable successful end-to-end execution of innovative strategies and deliver exceptional value with measurable results.

Why Botsford Associates

We think there is a better way to solve complex problems

Latest Highlights

-

Qualified Financial Contracts Recordkeeping Rule

October 2025

13 CFR Part 148 Regulatory Overview and Timeline, Availability, Maintenance of Records, and Exemptions, 13 CFR Part 148 Detailed Recordkeeping Requirements: Position-Level Data, Master Data Tables, Counterparty Netting Sets, Legal Agreements, Collateral Details

-

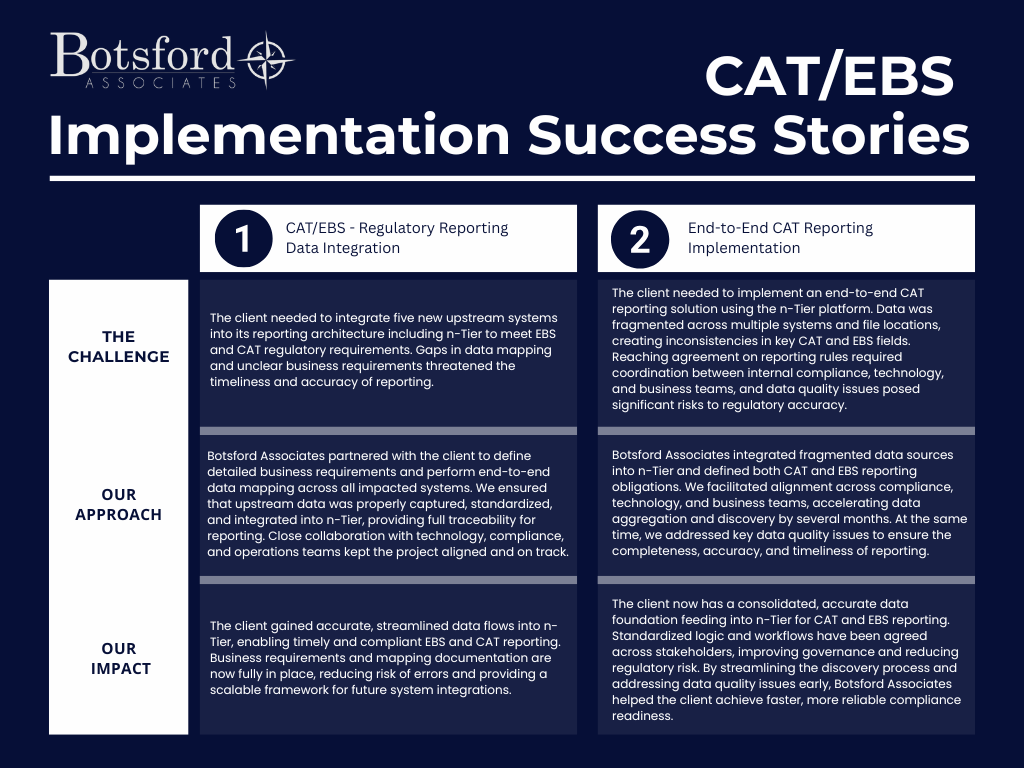

CAT/EBS Implementation Success Stories

We recently helped clients untangle complex EBS and CAT reporting challenges, integrating fragmented systems, fixing data quality issues, and accelerating compliance readiness.

The result? Cleaner data, faster reporting, and reduced regulatory risk. -

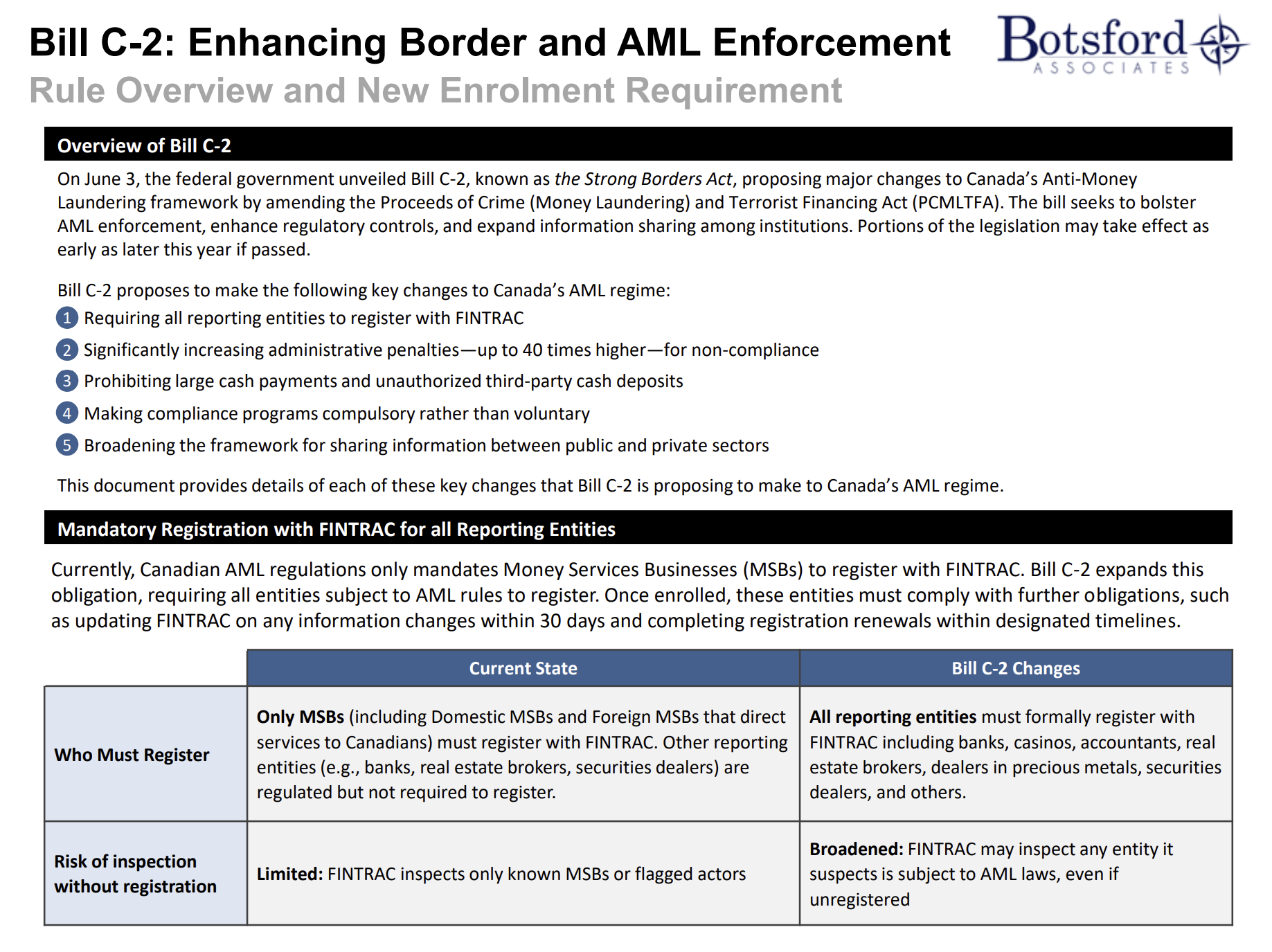

Bill C-2: Enhancing Border and AML Enforcement

September 2025

Rule Overview and New Enrolment Requirement, Mandatory Registration with FINTRAC for all Reporting Entities, Expanded Penalties for Non-Compliance, New Restrictions on Cash Transactions, Compliance Program Requirements, Expanded Information Sharing

-

Mergers & Acquisitions Integration (media clip!)

Deals make headlines.

Integration makes history.

Anyone can sign the deal.

Few can deliver the growth, retain the clients, and realize the synergies.That’s where Botsford Associates comes in. We help financial services organizations turn M&A potential into measurable, lasting success — faster, smarter, better.

What we do

We are dedicated to deeply understanding our client’s businesses and specific needs and partner closely with them to bring resourceful, impactful, and sustainable solutions that drive long-term success.

As a firm committed to staying at the forefront of technology, we continuously explore real-world applications of big data, predictive analytics, and cloud computing, leveraging these technologies to help our clients capitalize on opportunities for growth in an increasingly competitive market.

Practices

Capital Markets

Our leaders draw on experience in project transformation across all levels of business, from design to execution, to enhance operational efficiency, technological infrastructure, cost optimization, and automation initiatives.

Global Wealth and Private Banking

Firms need strategic frameworks that include the flexibility to evolve when crafting new and bold plans to remain resilient and profitable in a constantly shifting landscape.

Asset Management and Insurance

The industry is transforming as rapid digital innovations, market volatility, heightened client interest in ESG (environmental, social, and corporate governance) investments, and transparency around pricing, all collide to create new challenges.

Retail Banking and Payments

Banking is becoming an increasingly digital and customer-driven world with demands of on-the-go convenience and concerns around data protection at the forefront of a rapidly changing global economy.