Where Strategy Meets Execution

Global Reach, Local Presence

Botsford Associates is a boutique management consulting firm with deep subject matter expertise in capital markets, wealth management, and asset management.

We provide strategic guidance and tailored solutions to our client's most critical and transformative projects globally. Our project portfolio encompasses many initiatives, from complex regulatory changes to operational optimization and digital transformations.

By bridging the gap between business and technology, we enable successful end-to-end execution of innovative strategies and deliver exceptional value with measurable results.

Why Botsford Associates

We think there is a better way to solve complex problems

Latest Highlights

-

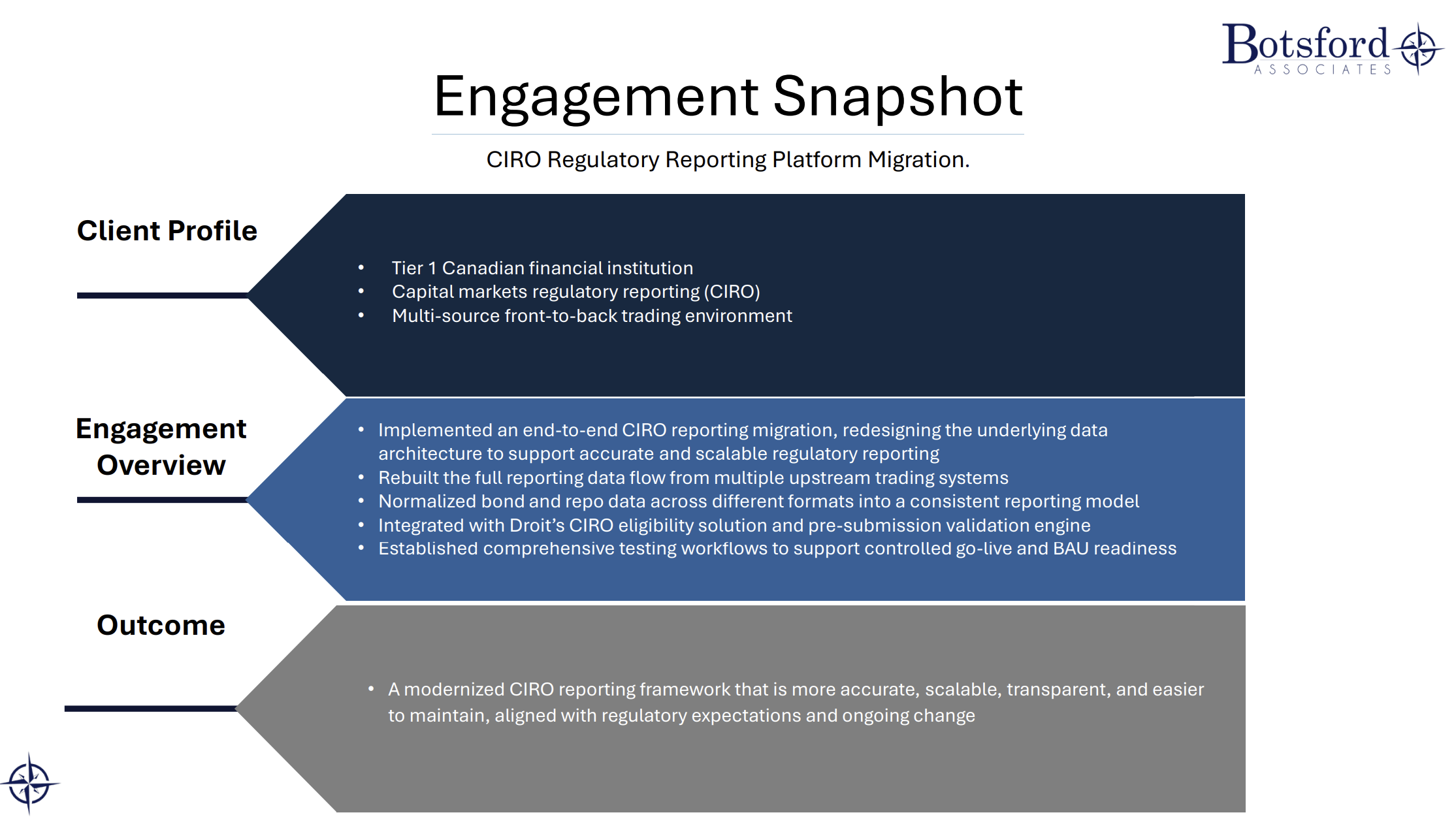

CIRO Regulatory Reporting Platform Migration - Engagement Snapshot

February 2026

See how we helped a Tier 1 Canadian financial institution modernize its CIRO regulatory reporting framework end-to-end: rethinking data architecture, eligibility logic, and operating model design to meet increasing demands for accuracy, transparency, and timeliness.

-

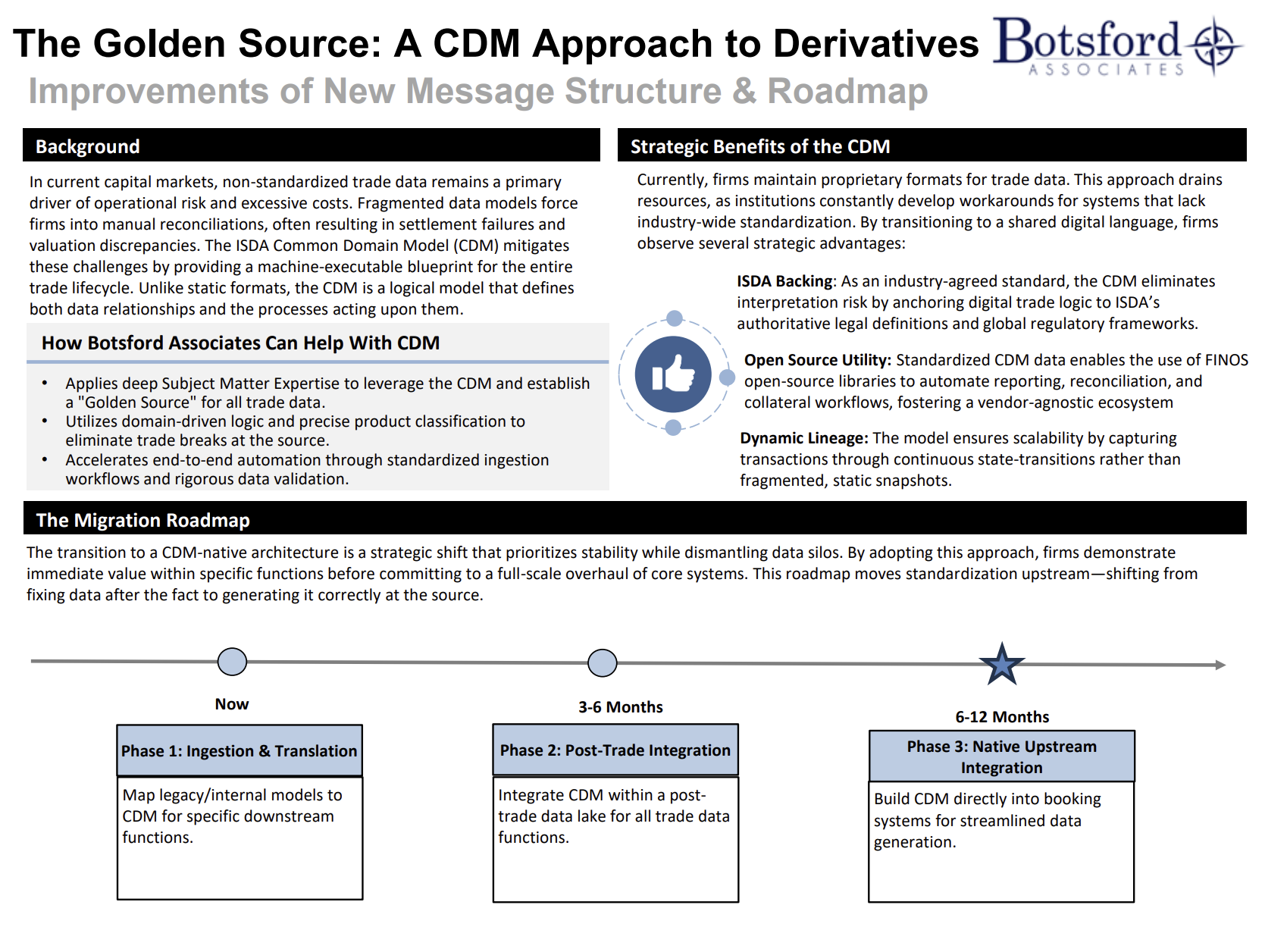

The Golden Source: A CDM Approach to Derivatives

February 2026

We explore how firms can move from fragmented, proprietary data models to a machine-executable, industry-aligned “golden source” using the ISDA Common Domain Model (CDM), through a practical migration roadmap—from mapping legacy models to CDM, to embedding CDM directly into post-trade and upstream booking systems—showing how standardization reduces downstream fixes, improves auditability, and unlocks automation across reporting, risk, and collateral.

-

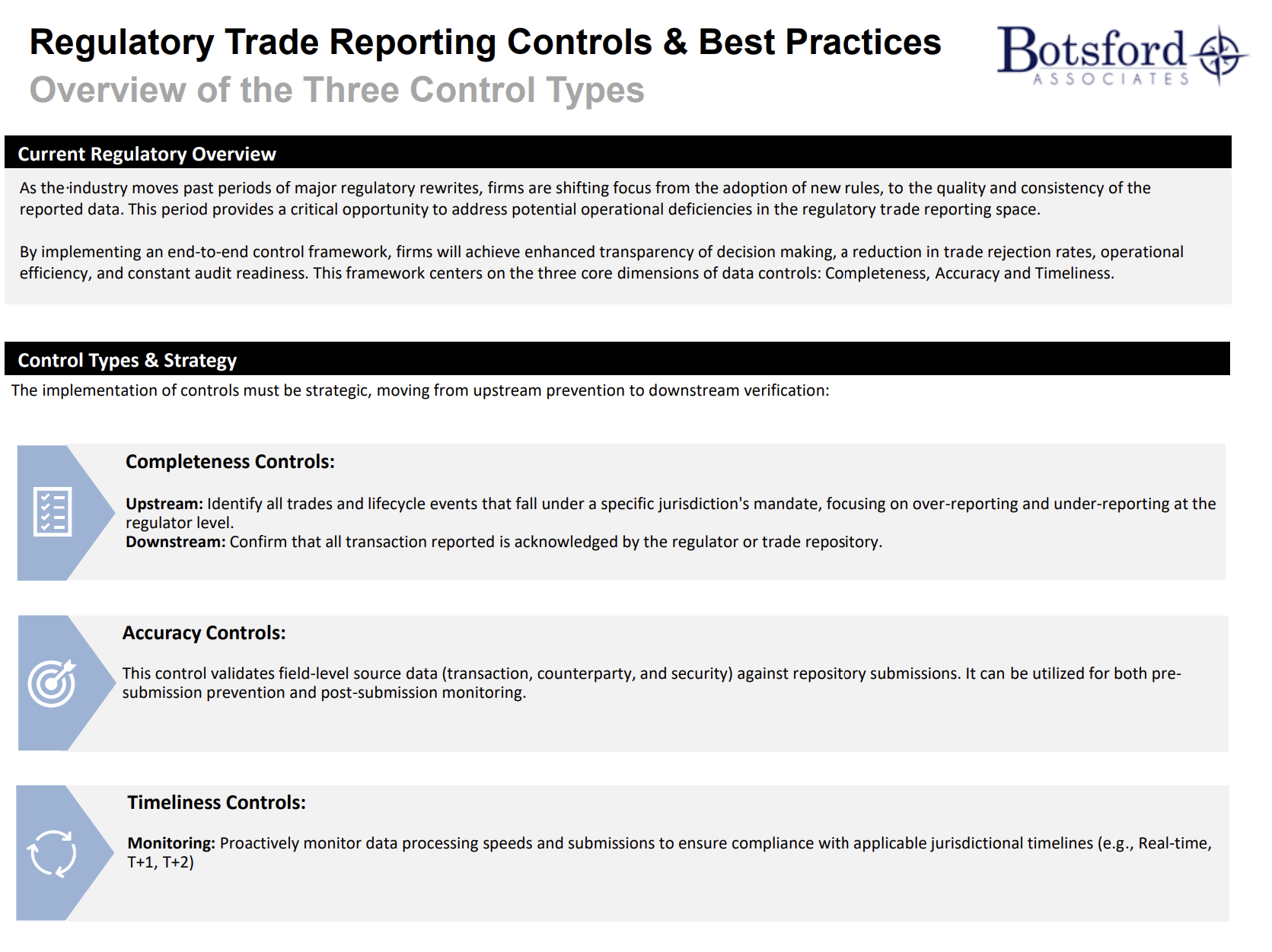

Regulatory Trade Reporting Controls & Best Practices

February 2026

Our latest white paper, Regulatory Trade Reporting Controls & Best Practices, outlines a practical, end-to-end control framework across the full reporting pipeline. It focuses on the controls that matter most today—preventing errors upstream, detecting issues early, and reducing reliance on manual remediation and vendor support. -

Engineering Operational Alpha in Your Aladdin Model

Most firms achieve system consolidation. Leading institutions capture sustainable competitive advantage. The decision to implement BlackRock's Aladdin platform will shape your operations and technology architecture for a decade or more.

What we do

We are dedicated to deeply understanding our client’s businesses and specific needs and partner closely with them to bring resourceful, impactful, and sustainable solutions that drive long-term success.

As a firm committed to staying at the forefront of technology, we continuously explore real-world applications of big data, predictive analytics, and cloud computing, leveraging these technologies to help our clients capitalize on opportunities for growth in an increasingly competitive market.

Practices

Capital Markets

Our leaders draw on experience in project transformation across all levels of business, from design to execution, to enhance operational efficiency, technological infrastructure, cost optimization, and automation initiatives.

Global Wealth and Private Banking

Firms need strategic frameworks that include the flexibility to evolve when crafting new and bold plans to remain resilient and profitable in a constantly shifting landscape.

Asset Management and Insurance

The asset management and insurance industry is transforming as rapid digital innovations, market volatility, heightened client interest in alternative and private markets, and transformative innovation in Al all collide to create new challenges.

Retail Banking and Payments

Banking is becoming an increasingly digital and customer-driven world with demands of on-the-go convenience and concerns around data protection at the forefront of a rapidly changing global economy.