Insights, Archived

Research, white papers and articles

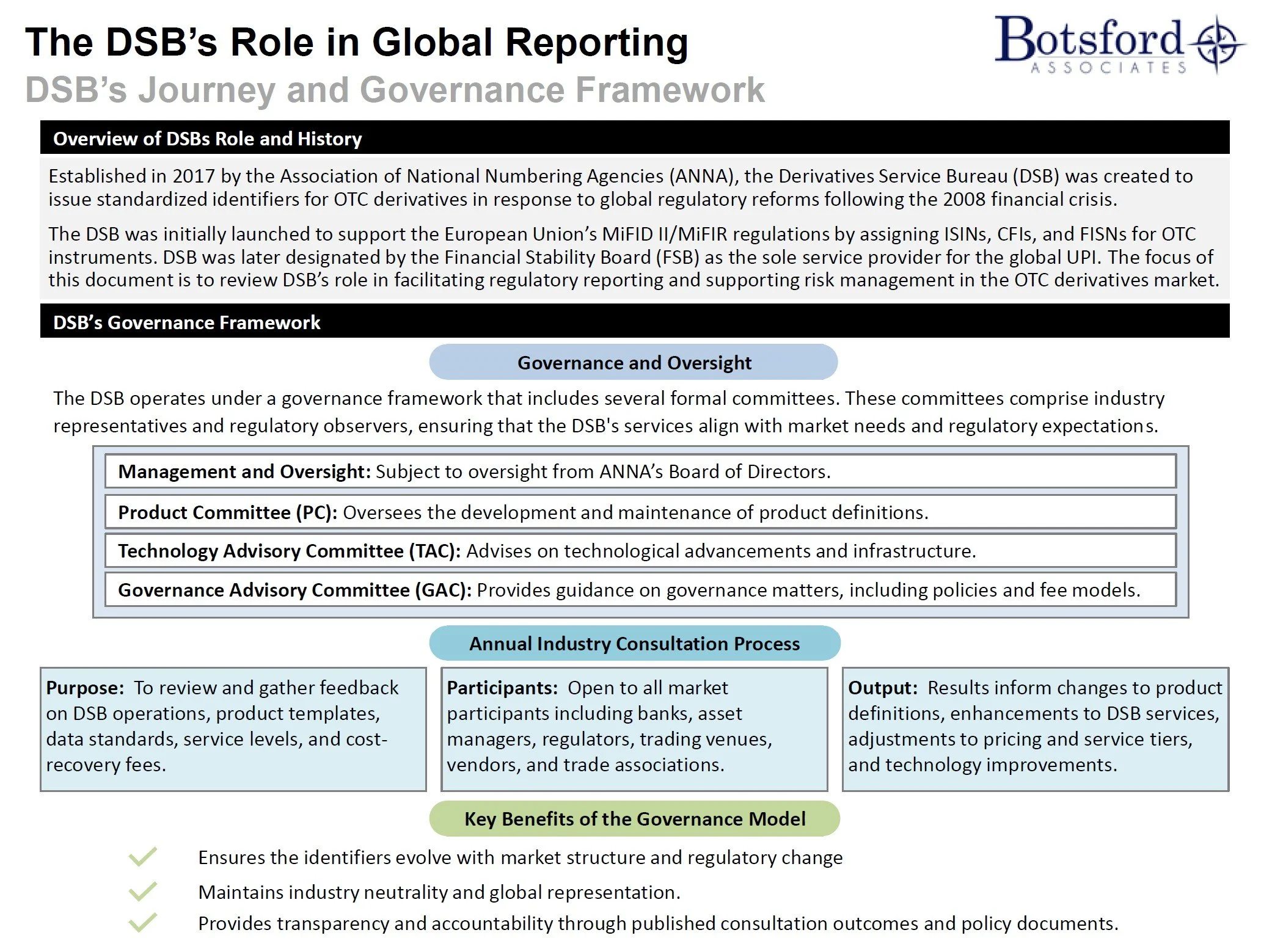

The DSB’s Role in Global Reporting

Overview of the Derivatives Service Bureau (DSB) Role, History and Governance Framework, The DSB’s Role in Global Reporting including DSB Identifiers Driving OTC Market Transparency and Global Regulations Powered by DSB Identifiers

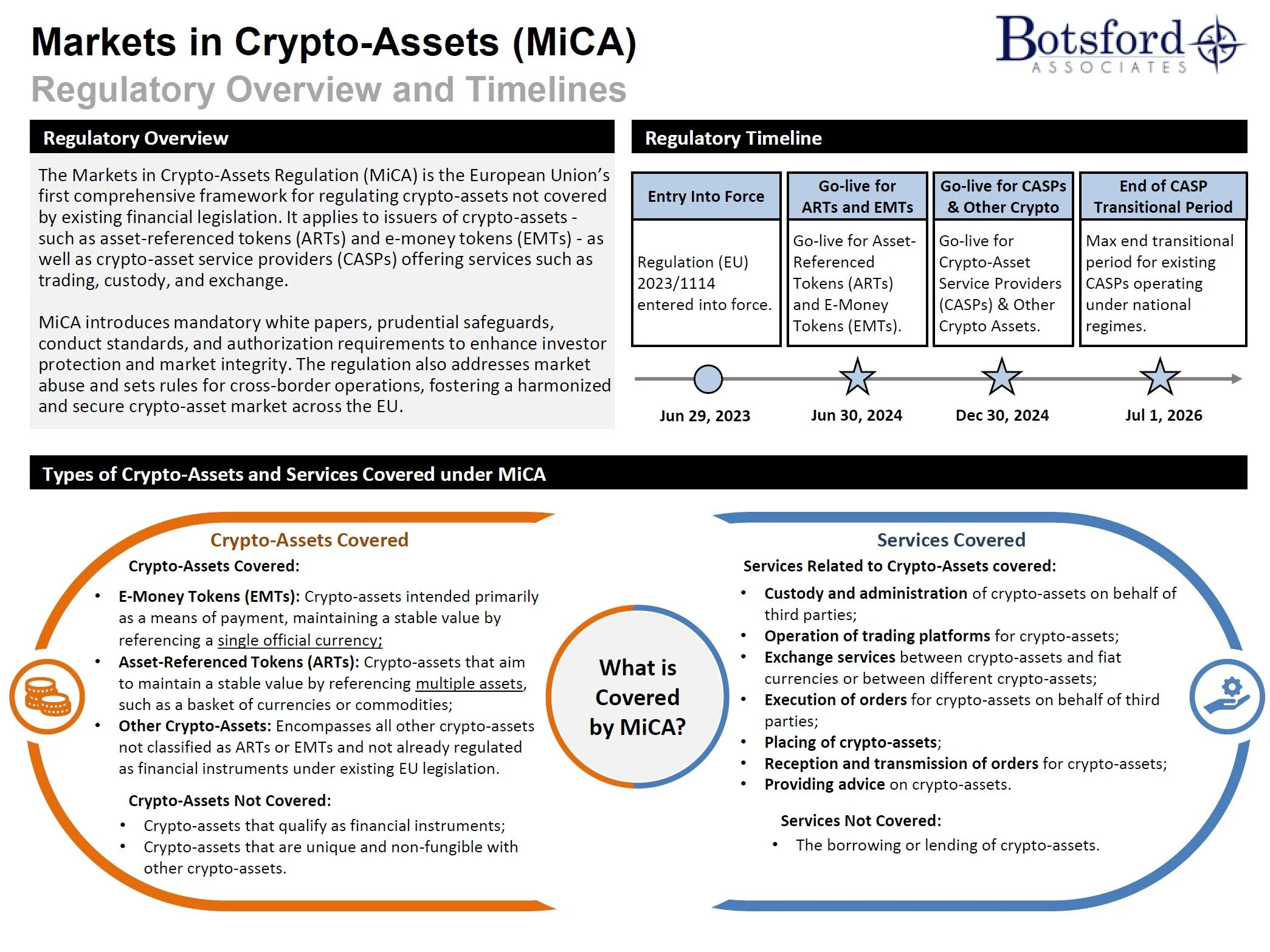

Markets in Crypto-Assets (MiCA)

Regulatory Overview & Timeline, Types of Crypto-Assets and Services Covered under MiCA, Rules for Issuers of Crypto-Assets, Crypto-Asset Service Providers (CASPs) Regulatory Framework and Prevention of Market Abuse Involving Crypto-Assets

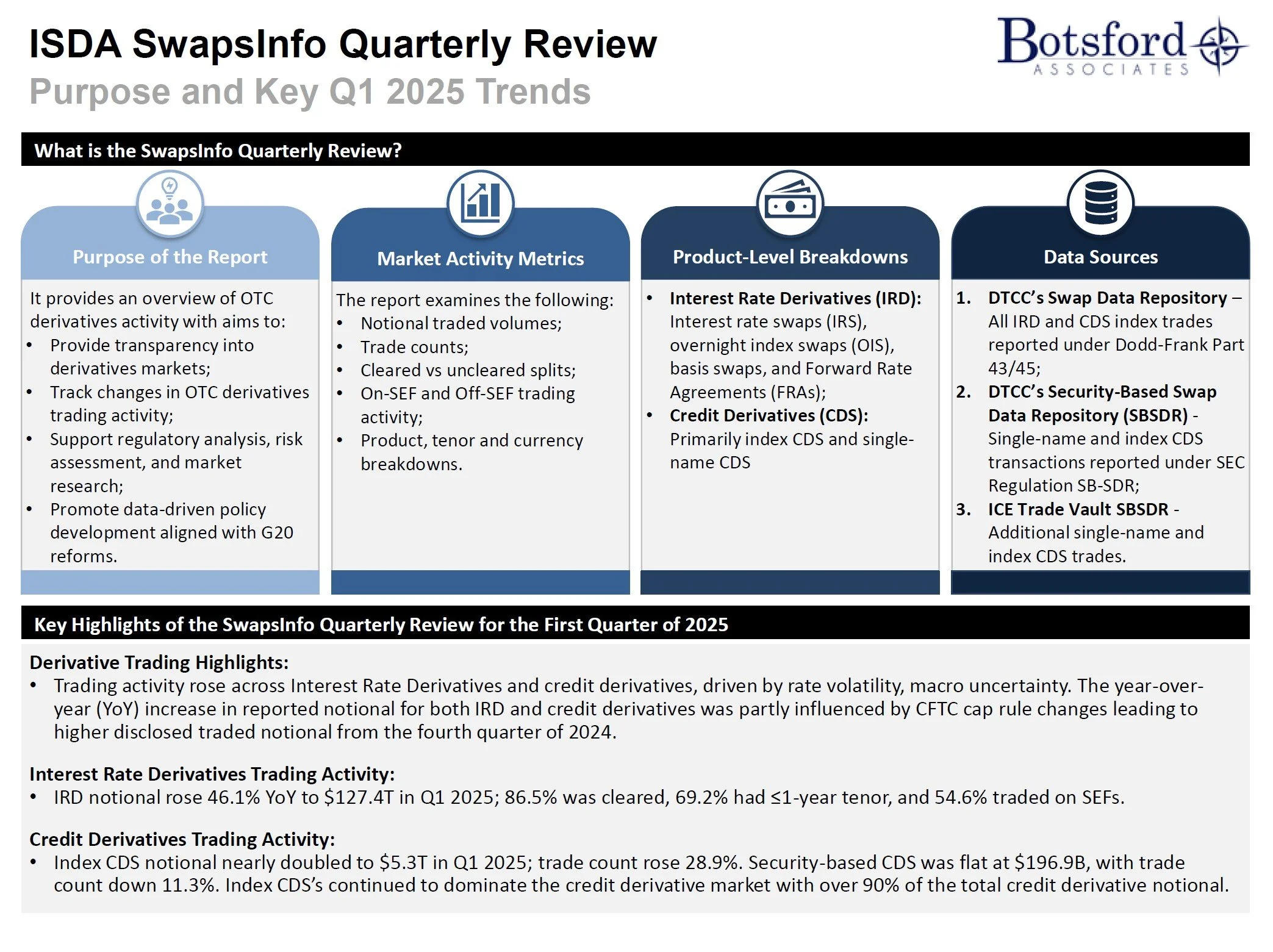

ISDA SwapsInfo Quarterly Review

What is the SwapsInfo Quarterly Review? Key Highlights of the SwapsInfo Quarterly Review for the First Quarter of 2025, Key Highlights for Q1 2025: Interest Rate Derivatives, Key Highlights for Q1 2025: Credit Derivatives

Bay Street Games Update - Watch us in action! (Video)

Earlier this month, the Botsford team had the incredible opportunity to take part in the Bay Street Games, hosted by Capitalize for Kids. It was an unforgettable experience, rallying for a cause that truly matters: supporting youth mental health.

Strengthening Canada's AML/ATF Framework

Regulatory Overview and Timeline, Summary of the Key Changes, Trade, Information, and Ownership Reforms, Sectors Added to Canada’s AML/ATF Regime

2025 Financial Services Regulatory Outlook

Key Regulatory Trends, Upcoming OTC Derivative Trade Reporting Rules: Canada - CSA, United States - CFTC, Hong Kong - HKMA and SFC, European Union - ESMA, Regulations with Upcoming Go-Live Dates across North America, Europe, and Asia, including Global Industry Initiatives

Supporting Youth Mental Health at the Bay Street Games!

In recognition of Mental Health Month, we are thrilled to share that we will be participating in the Capitalize for Kids Bay Street Games on June 5th!