Insights, Archived

Research, white papers and articles

Open Banking in Canada

Key Policy Objectives for an Open Banking System in Canada, Timeline of Events to Establish an Open Banking System in Canada, Implementation Plan as Proposed in the Final Report by the Advisory Committee, Details of Bill C-365, the Consumer-Led Banking Act

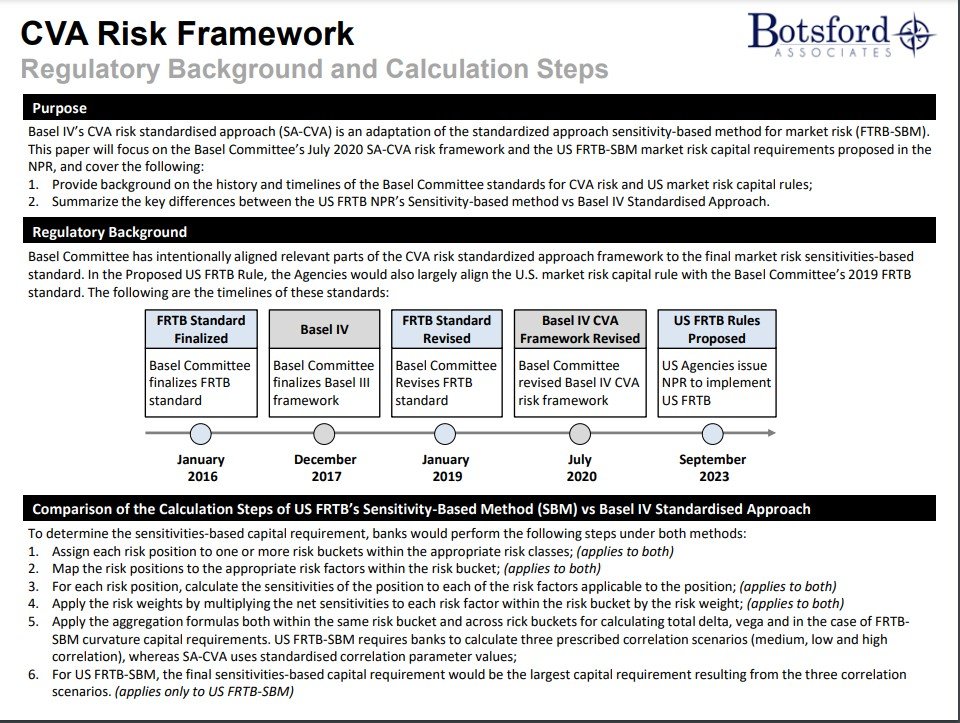

CVA Risk Framework

Purpose and Regulatory Background, Comparison of the Calculation Steps of US FRTB’s Sensitivity-Based Method (SBM) vs Basel IV Standardised Approach, Differences Between SA-CVA and US FRTB-SBM

OSFI Guidelines B-10 and B-13

Overview, Compliance Dates, Foreign Branches In-Scope of Guideline Amendments, Regulatory Objectives of Guideline B-10, Regulatory Objectives of Guideline B-13, Third-Party Risk Management Requirements, Technology and Cyber Risk Management Requirements

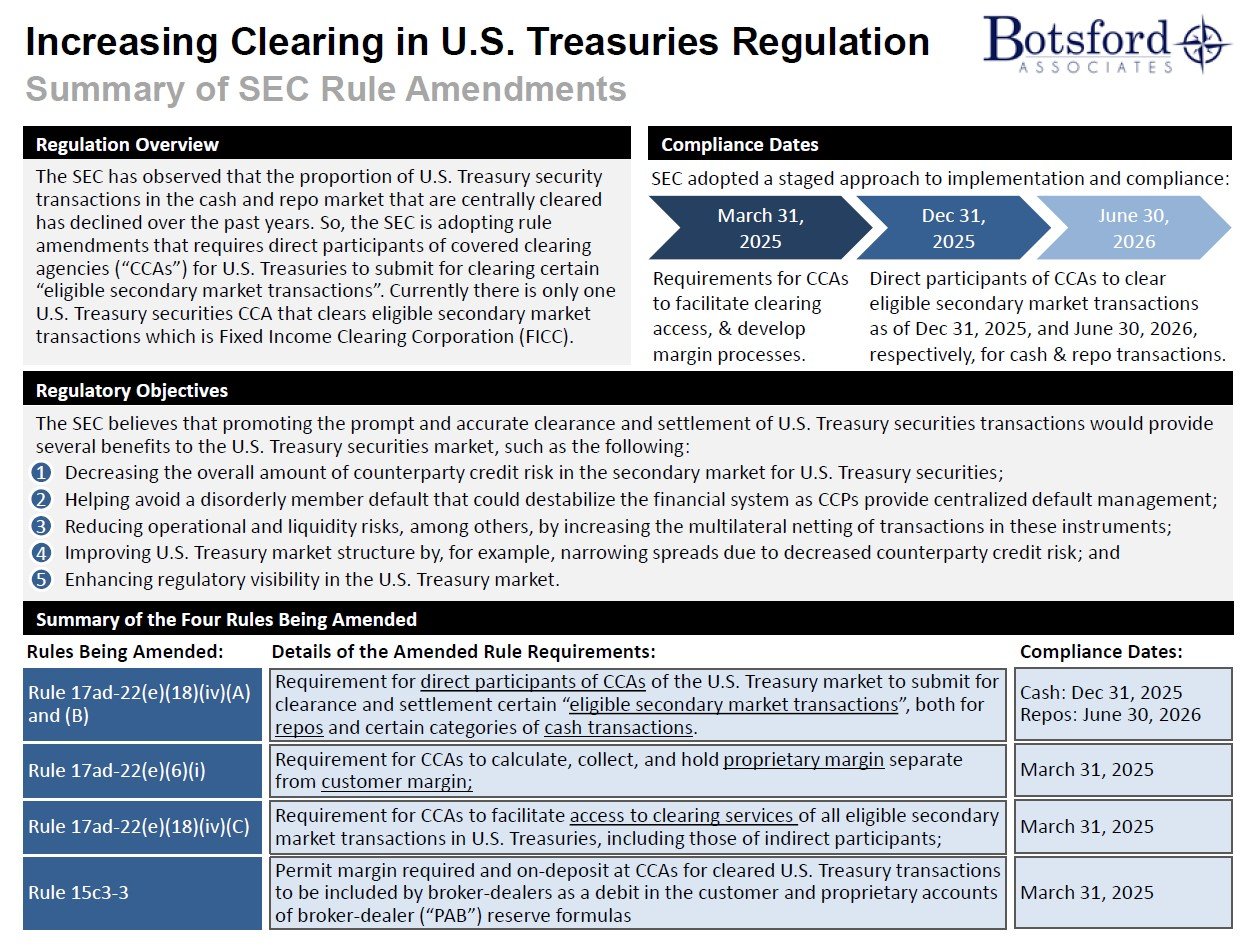

Increasing Clearing in U.S. Treasuries Regulation

Regulation Overview, Regulatory Objectives, Compliance Dates, Summary of the Four Rules Being Amended, Definition of “Eligible Secondary Market Transactions”, Requirement for the Separation of House and Customer Margin, Requirement for Access to Clearing and Monitoring of Compliance

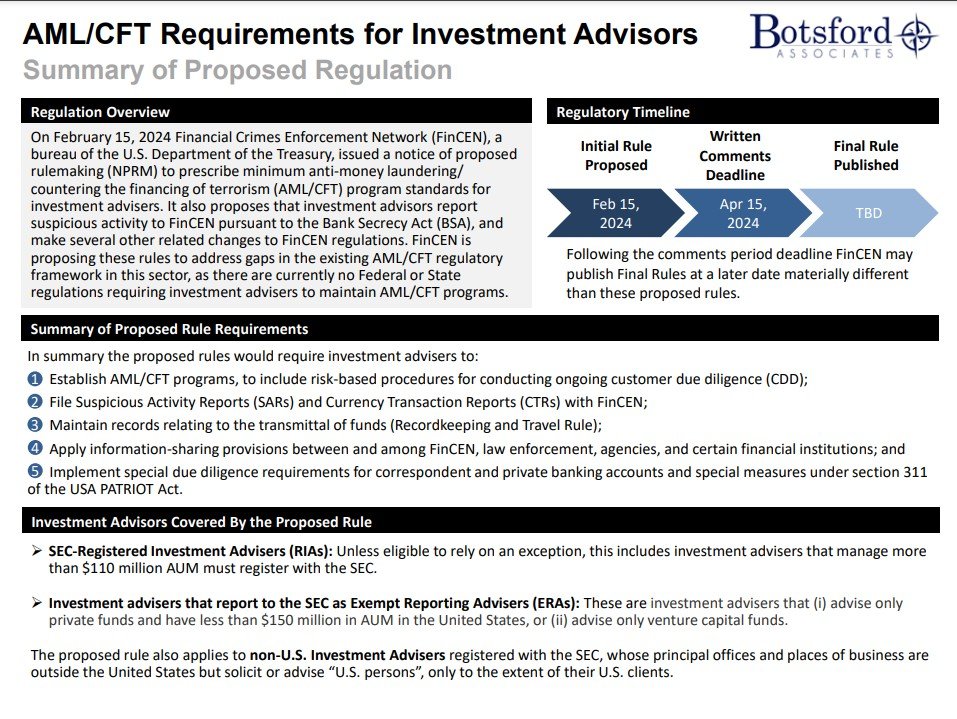

AML/CFT Requirements for Investment Advisors

Regulation Overview and Timeline, Summary of Proposed Rule Requirements, Investment Advisors Covered By the Proposed Rule, AML and CFT Programs, Proposed Obligation to File SARs and CTRs Instead of Form 8300, Proposed Recordkeeping Requirements, Special Information-Sharing Procedures to Deter Money Laundering and Terrorist Activity

Continued harmonization with an investor protection focus: CSA MI 93-101 and MiFID II

On September 28, 2024, the CSA MI 93-101 Derivatives: Business Conduct will come into effect with a five-year transition period. The instrument sets out a comprehensive framework for regulating conduct within the OTC derivatives market, including providing provisions on fair dealing, suitability among others

Basel IV

Regulation Overview, Implementation Dates and Transitional Arrangements, Revisions to the Internal Ratings-Based (IRB) Approaches for Credit Risk, Revisions to the Standardised Approach for Credit Risk, Revisions to the CVA Risk Framework, Operational Risk Framework, Leverage Ratio Framework and Introduction to a New Output Floor