Continued harmonization with an investor protection focus: CSA MI 93-101 and MiFID II

March 2024

On September 28, 2024, the CSA (Canadian Securities Administrators) Multilateral Instrument (MI) 93-101 Derivatives: Business Conduct will come into effect with a five-year transition period for market participants to implement new requirements. The instrument sets out a comprehensive framework for regulating conduct within the OTC derivatives market, including providing provisions on fair dealing, suitability, know your derivatives party, conflicts of interest, and tied selling among others. 93-101 aims to address regulatory gaps to protect market participants while mitigating risks through enhanced transparency, and bolstering confidence in Canadian markets through increased accountability. The regulation has been adopted by the regulatory authorities in all Canadian Provinces and Territories governed by the CSA, except for the British Columbia Securities Commission (BCSC) who intends to adopt similar rules at a later date. In future, the CSA also intends to convert 93-101 to a National Instrument.

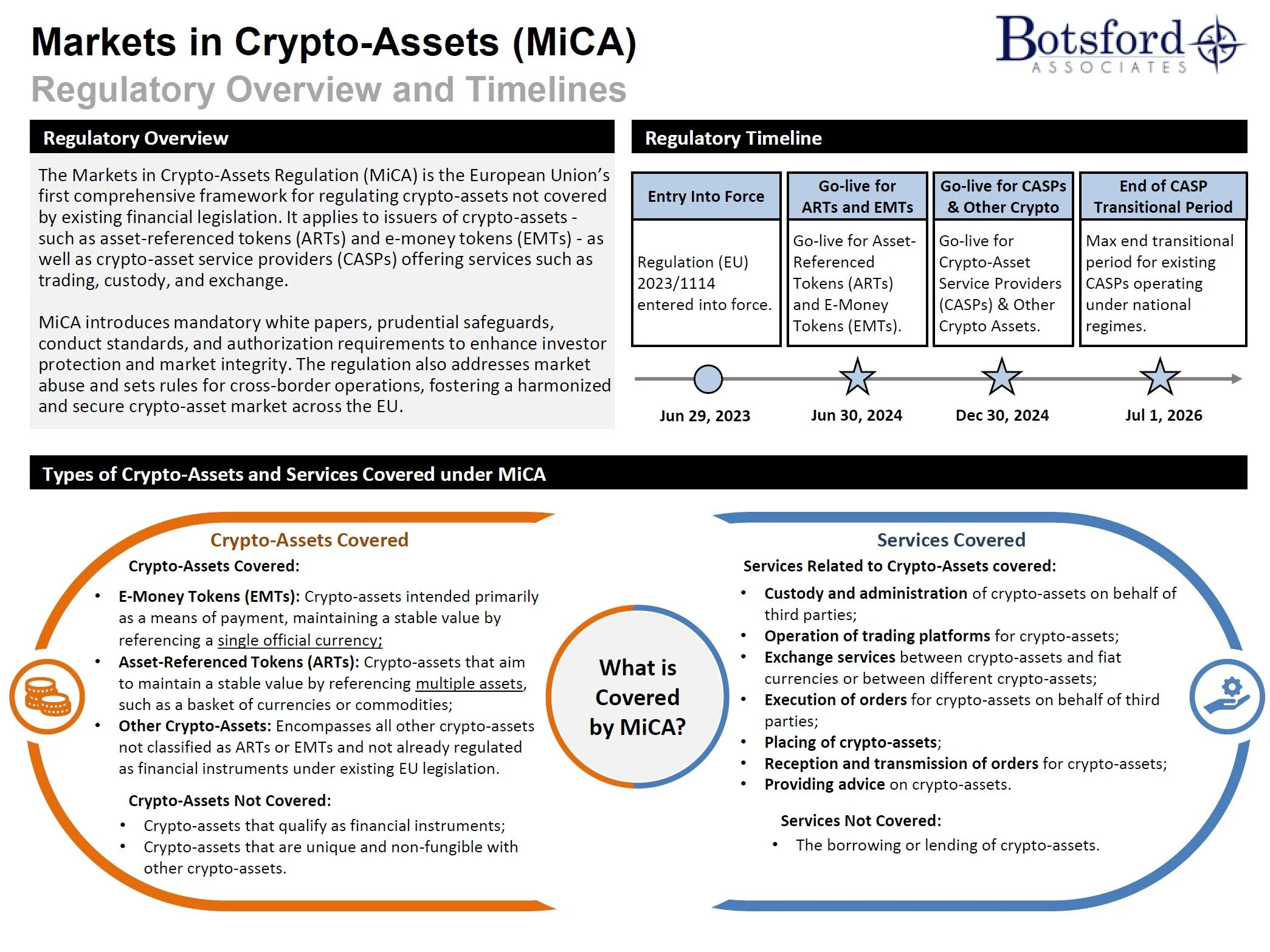

The European Commission and UK have drafted several amendments to the Markets in Financial Instruments Directive (MiFID II) and Markets in Financial Instruments Regulation (MiFIR). On January 16, 2024, the European Parliament voted to adopt revisions. The aim, to optimize orderly trading, enhance market data transparency, and most notably, protect investors by prohibiting payments for forwarding client orders for execution (ie. banning payment for order flows). By enhancing the transparency and availability of market data, including making information about investment products, services and costs easily accessible, the latest MiFID II/MiFIR amendments seek to empower retail investors with the knowledge to make informed investment decisions.

Retail investor protection is a key component for both 93-101 and Mifid II. Both frameworks cover requirements on suitability, disclosure and transparency, compliance and recordkeeping among others. While each set out distinct requirements, their similarities could be leveraged for more efficient compliance and risk management practices, especially as regulators work towards harmonization and standardization across financial markets. Prior to the application of 93-101, Canada was the only G20 country without business conduct standards for the OTC derivatives market. In establishing 93-101, the CSA stated it would meet the international standards set out by the International Organization of Securities Commissions (IOSCO), and the regulatory approach taken by most IOSCO jurisdictions with active OTC derivatives markets. As such, the new requirements in Canada align closely with those in the European Union and the United States, as most jurisdictions endeavor to harmonize rules for consistency with other regulators.

Andrew Moreira

Managing Director

amoreira@botsford.com

LinkedIn