Challenges in Enhanced Reporting: CFTC Rewrite Phase 2 and EMIR REFIT

January 2024

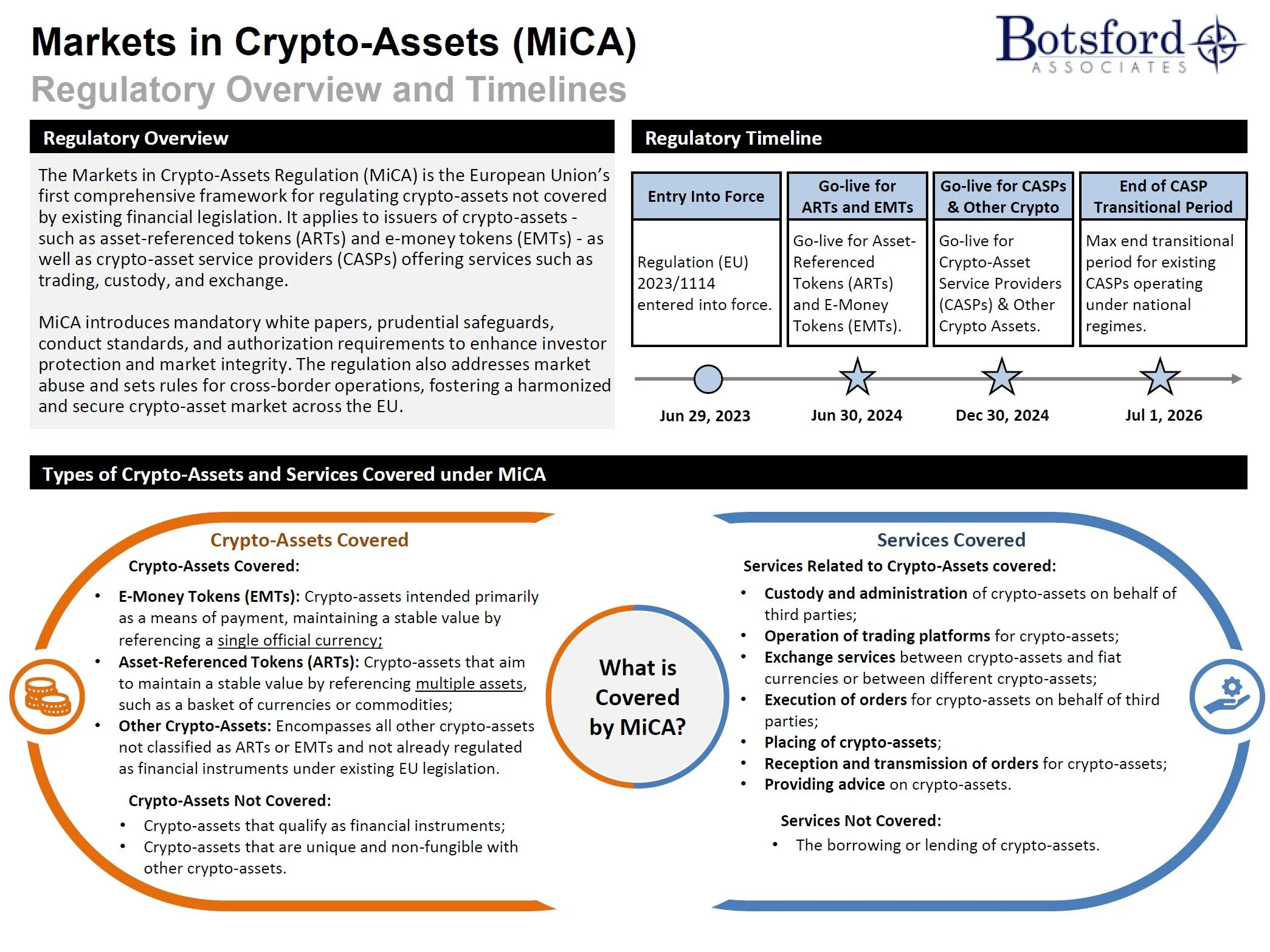

Firms continue to contend with regulatory challenges as the drive to standardize regulatory reporting persists. Regulators continue to strengthen their focus on transparency and harmonization, particularly in the derivatives space with deadlines around the corner. Firms should be making significant progress in the development, testing and implementation phases with CFTC ReWrite Phase 2’s deadline January 29, the EU EMIR REFIT going live April 29 2024, followed by the UK EMIR REFIT on September 30 2024.

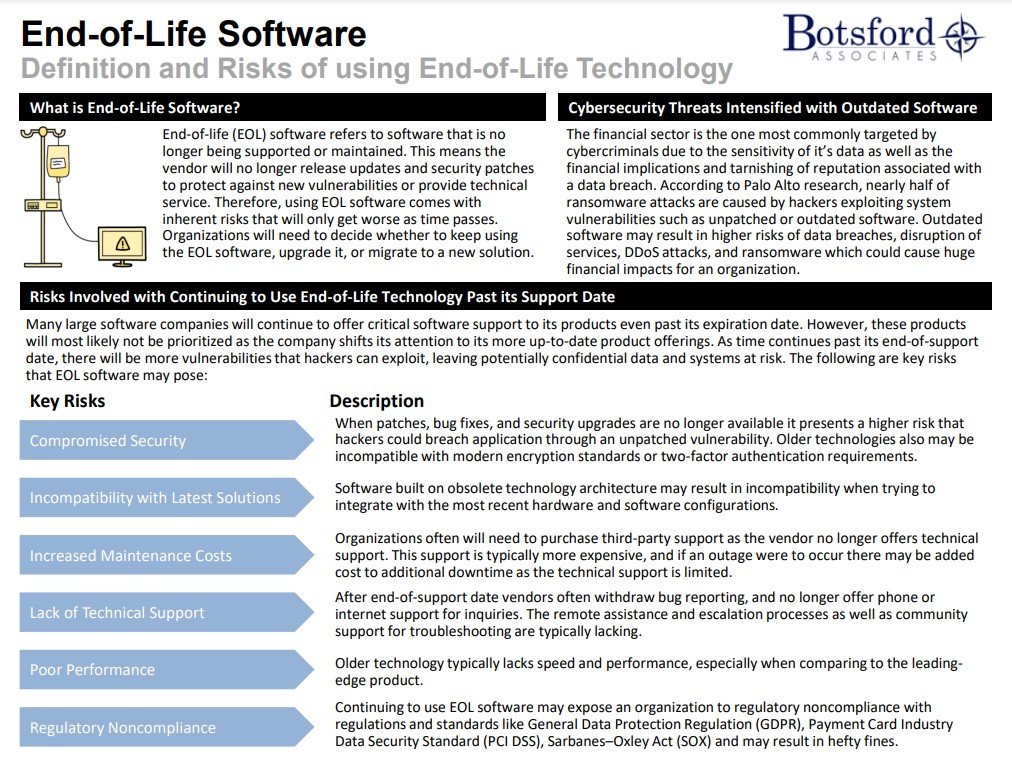

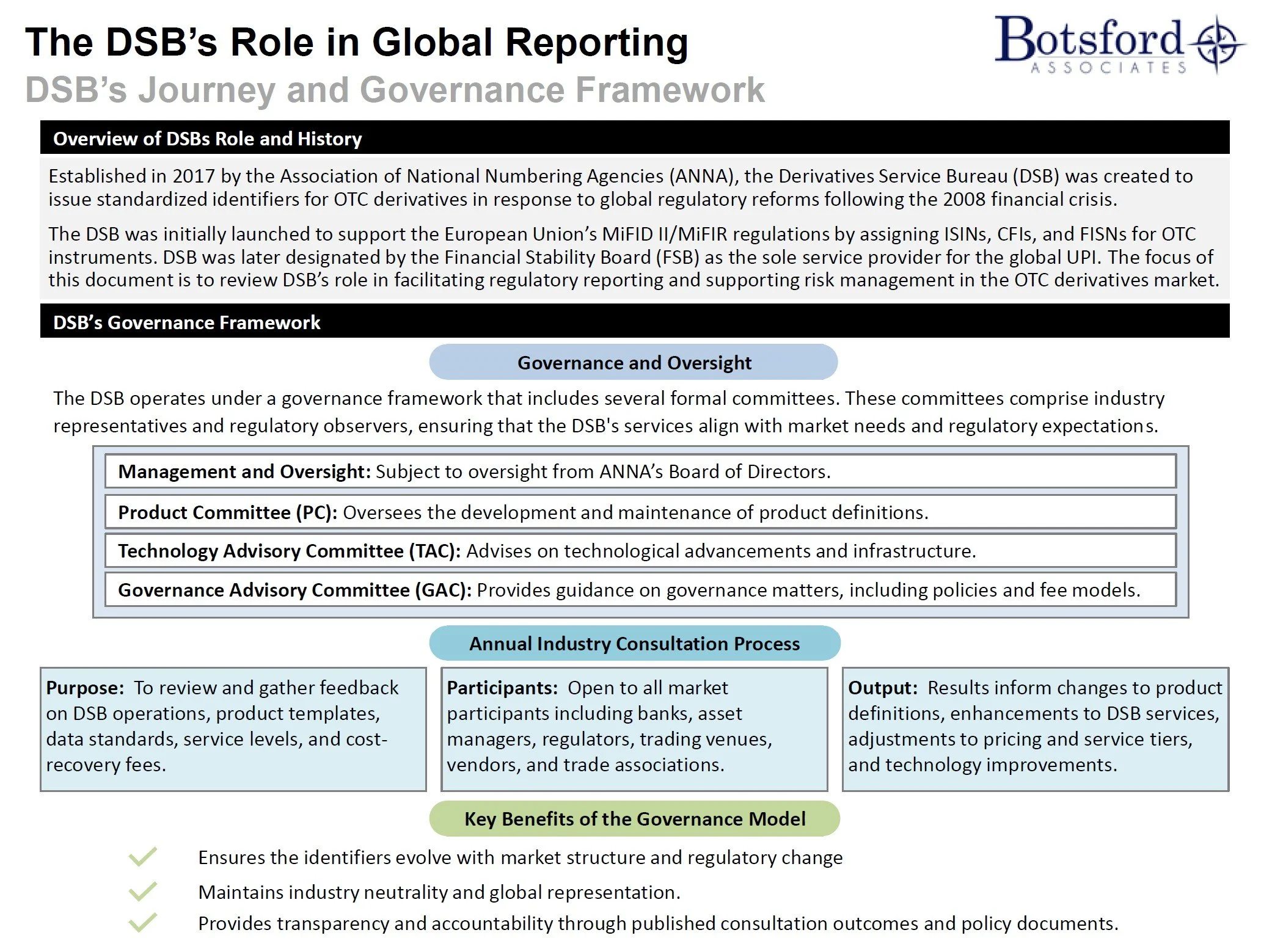

One of the primary hurdles firms encounter is the demand for enhanced reporting capabilities. The adoption of UPIs (Unique Product Identifier) for both CFTC ReWrite Phase 2 and EMIR REFIT, which help regulators monitor systemic OTC derivative risks at a global level, highlight the challenges firms face when implementing new regulations. Current systems will need to incorporate UPI data into existing reporting infrastructures, or require meticulous overhauls to align with the new requirements. Adapting internal platforms, especially legacy technologies, to manage large volumes of new data, while ensuring accuracy and consistency, can pose a significant burden on a firms’ resources and operations. For expertise, firms are finding it increasingly difficult to source resources who are able to keep pace with, and provide the necessary guidance that increased regulatory scrutiny demands.

EMIR REFIT introduces a substantial increase in the volume and granularity of data that must be reported, including an increase in reportable fields from 129 to 203, and changes to the format and content in existing fields among other items. To address this, firms need data management systems capable of handling the influx of information efficiently. Technology-driven solutions can play a pivotal role; leveraging advanced analytics and artificial intelligence can streamline data processing, enhance accuracy, and automate reporting procedures. The integration of agile and scalable technologies can allow firms to adapt to evolving standards without disrupting their day-to-day operations.

There’s been prominent growth in the use of vendor solutions to manage the financial and operational burdens of regulatory reporting and compliance. Moving to a vendor or managed services solutions approach not only reduces end-to-end reporting costs, but also brings the benefits of extensive industry expertise. Vendor solutions can also bring the latest technological advantages that might not be implemented easily in-house, along with flexibility and scalability for a predictable cost structure in uncertain times.

As regulatory adherence is a constant imperative, and regulators move to adopt policies that bring about standardization across jurisdictions, firms must continue to position themselves to adapt seamlessly to withstand the challenges of global compliance.

Andrew Moreira

Managing Director

amoreira@botsford.com

LinkedIn